5 Commons Myths about Legacy Giving that Hold Fundraisers Back

Sep 14, 2023

“I found this company, and they bury you in a biodegradable sack. So when your body decomposes, it fertilizes the seeds of a fruit tree. That's what I want. Because then you and all the people that love me can eat the fruit from my tree.” Said Keeley in Ted Lasso Season 2, episode 10. “...I just like the idea that my death can nourish people.”

While this scene is somewhat humorous it demonstrates a desire most people have to leave a legacy. We don’t usually use the word legacy, though. We use words like, “I want to be remembered for ______,” or “I want to make a difference.” What we’re expressing is a desire to pass something forward when we are no longer here.

We all leave legacies with the way we live our lives and the plans we make for our resources. As fundraisers we have the privilege of helping our supporters clarify their legacies and make them official through legacy gifts.

While inviting legacy gifts is one of the best ways for donors and fundraisers to support what they believe in, fundraisers are often intimidated most by this work and avoid it altogether. There are five common myths about legacy giving that cause this topic to make fundraisers want to run for the hills. In this article I am going to debunk each myth and give you tools to invite legacy gifts with confidence.

What is a legacy gift and why should nonprofits invite them?

Planned giving is a term used by the nonprofit sector to describe gifts that are given from assets instead of cash. At Brenda Moore and Associates we prefer the comparable term “legacy gift” because it infers more about what planned gifts accomplish.

Churches, ministries, and nonprofits should invite legacy gifts for two reasons: they are on the rise due to the Great Wealth Transfer and they allow people to leave a legacy of faith.

- Legacy gifts will be the preferred form of charitable giving. In 2022, Americans gave almost $500 billion to charity. 9% of all giving in 2022 was given through bequests. Over the next 15 years, Cerulli estimates that gifts through bequest will equal all other charitable giving.

- Legacy gifts allow us and our donors to pass on our faith to future generations. A mission without money can’t exist. When an individual leaves a financial legacy to a church or ministry that invests in faith they are providing for others to know God through that organization.

Many of your donors would cherish the opportunity to ensure that your mission can continue to exist through a legacy gift. As legacy gifts become the preferred way to make charitable gifts it is imperative that faith-based nonprofits intentionally educate about and invite these gifts.

5 Myths about Legacy Giving

I’m not proud of what I’m about to tell you, but I avoided legacy giving for the first few years of my career. It seemed too complicated and technical for me to do successfully. What I didn’t know then is that the complicated technical parts of legacy giving aren’t usually the work of fundraisers; they’re more likely the work of other professional advisors like estate planning attorneys, accountants, financial planners and wealth managers. When I understood this I was able to start inviting legacy gifts with confidence.

Now that I’ve been doing this work for 40+ years and made legacy giving the focus of my career I have identified five myths about legacy giving that keep fundraisers from doing their very best work. Keep reading to learn how you and your donors can begin making your very best gifts!

MYTH #1: Donors don’t want to talk about will-making.

My journey of inviting legacy gifts started when a woman who was diagnosed with terminal cancer asked me to help her make a beautiful plan to bless her children and her church. She initiated the will-making conversation, not me!

This story illustrates that people do want to talk about creating a legacy and planning what they are passing forward. These things are reminders of joy and the future. What people don’t want to talk about is death and what they will leave behind. These are reminders of mortality.

Instead of death and leaving behind, legacy giving conversations should be about what we pass forward.

How to start a will-making conversation

The best way to start these conversations is with gratitude. After expressing gratitude, ask a question to understand what motivates their generosity. Once you understand their motivations, connect that with your organization’s need(s).

Here is a simple three step system I use to start will-making conversations. You can remember it easily as TAC: Thank, Ask, Connect. I encourage you to borrow the sequence and adjust it to make it your own:

- Always start with, “Thank you, the generosity of your gift has made [SPECIFIC THING] possible.”

- Ask a question, “What inspired your generosity over the years?”

- Connect their motivations, “Betty, I really admire your commitment to this school. You have been a faithful contributor to this institution since you graduated. You’ve said it’s important that this education is available to future generations. Have you ever thought about including this organization in your will?”

You will find that many people have thought about including your organization in their will, they just didn’t know how to start the conversation. You only need to get the topic on the table, listen to their initial response, and end by asking “Would you be willing to continue this conversation sometime soon?” Inviting your supporters to discuss legacy giving at a later time gives you both time to prepare.

MYTH #2: We don’t have years for these gifts to materialize; we need cash NOW.

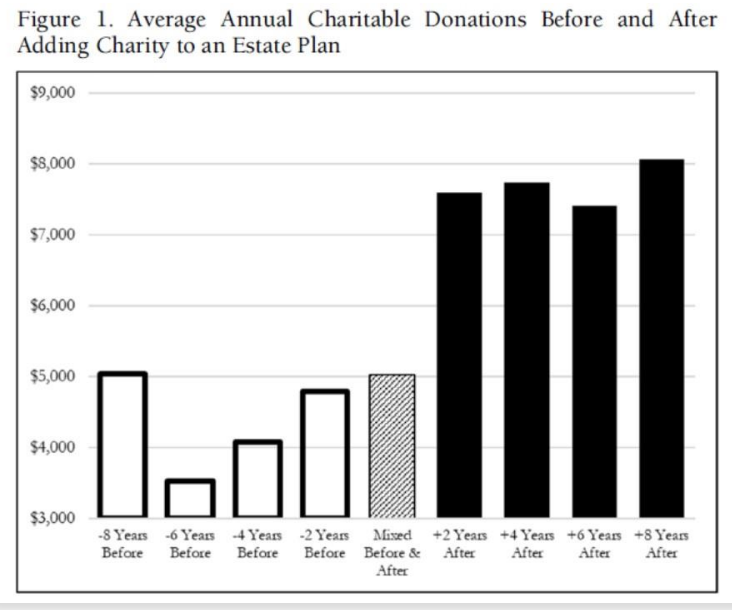

Legacy gifts can increase your current gifts immediately in two ways. First, several forms of legacy gifts can create current gifts while also being given to you later. Second, donors who include you in their will usually increase their current giving by 2-6Xs. Let’s unpack what makes these two things possible.

First, here are three assets that can create legacy gifts and current gifts.

- An IRA is a great asset to use for both current and future gifts. Donors can make a Qualified Charitable Distribution (QCD) from their IRA beginning at age 70½ and also name ministry as beneficiary of the IRA’s remaining value at their death… all without paying any tax.

- Gifts of stock create incredible tax advantages for donors when gifted directly to a nonprofit. And in almost every state, your brokerage can help you name a nonprofit as a transfer-on-death beneficiary.

- Gifts of land are more complex, but they can continue to produce an income for the giver, and that makes these gifts worthy of the effort. Real estate can be given directly to a charity, and the sale of that property can fund large gifts now but also fund a charitable trust. The trust provides an income to the donor for a period of time, and the remaining value of the trust comes to the nonprofit later.

Secondly, FreeWill’s research indicates that nonprofits receiving stock gifts grow 6Xs faster than nonprofits only receiving cash. According to research by Dr. Russell James, “nonprofits accepting non-cash assets saw 66% revenue growth over a five-year period compared to those accepting only cash.”

Inviting and securing legacy gifts means a significant portion of these gifts will come to you later, but your annual giving will increase at the same time.

MYTH #3: Legacy giving is only for large organizations.

Typically, 20% of universities’ gift income comes from bequests. The income the average nonprofit receives from bequests is about 10%. Unfortunately, from that data, we can deduce that the amount of bequest gift income smaller organizations and faith-based nonprofits receive is far less than the average 10%.

This doesn’t mean small organizations or faith-based organizations can’t invite legacy giving. In most circumstances it just means that small organizations and faith-based organizations haven’t been inviting these gifts. Consider the following graphic.

European castles took years to build. They are impressive, but they’re impressiveness didn’t happen overnight. Similarly, universities have spent decades inviting legacy gifts. Receiving 20% of their gift revenue through bequests is impressive, but it didn’t happen overnight.

A typical house in America provides shelter and comfort to its residents. It didn’t take as long to build as the castle, but it still provides shelter. Organizations that receive 10% of their gifts through bequests have spent time inviting these gifts. The work they have done is providing stability for their organization.

Tents don’t take long to set up, in comparison to building a house or castle. They also struggle to withstand less than ideal situations for the long haul. Organizations that receive less than 10% of their gifts from bequests haven’t spent much time inviting legacy gifts. As a result they struggle financially through less-than-ideal situations.

The impressiveness of each structure is very much related to the time it took to build. Similarly, the amount of gifts received through bequests to nonprofit organizations is very much related to the time and energy spent inviting legacy gifts.

Here are examples of two small nonprofits that created strong legacy giving programs:

- Mount Carmel Ministries, a small outdoor ministry with an annual budget of $1.3 million, received an average 30% of their charitable donations from legacy giving while my colleague, Jana Swenson CFRE served as their Director of Development. During a period of transition, bequests not only provided a revenue safety net but also served as a launch pad for growing other forms of gift income.

- Nebraska Lutheran Outdoor Ministries, another outdoor ministry organization with an annual budget of $3million, has incrementally increased its investment in legacy giving over the past 30 years. Today, their bequest expectancies total $30million — that’s 10X their annual budget!

Inviting legacy gifts is not reserved for large organizations. It’s accessible to any organization willing to regularly invest in the work and extend the invitation.

MYTH #4: Our donors don’t have the capacity to make these gifts.

Fundraisers want to make sure their donors have the capacity to make a legacy gift before they invite one. This makes sense. No one wants to ask for a gift that someone is unable to give. However, a donor's perceived capacity is not the primary predictor that they will give. There are four predictors of legacy gifts that are more important than a donor's capacity.

- Predictor #1: Individuals don’t have heirs. Donors who don’t have heirs are 5Xs more likely to leave a bequest to a charitable organization.

- Predictor #2: Donors have given 15 or more gifts to your organization in their lifetime. We’ve known for a long time that loyalty is a strong predictor of potential legacy gifts. However research by Dr. Russell James found that 80% of bequests are given by donors who have made 15 or more gifts to the organization in their lifetime.

- Predictor #3: Volunteers. Giving time to your organization shows that a supporter is invested in the well-being of your organization. Always value non-financial investment in your organization.

- Predictor #4: Individuals who have turned 70. People can include you in their estate at any age but generally speaking you can get really serious about these gifts about age 70. Typically, people need to live into their retirement about five years to know their financial status and be ready to write charitable distributions into their wills.

Though capacity is not a good predictor of a donor's decision to make a legacy gift, most donor’s have the capacity to make much larger gifts through their estate plans. The average American holds 90 percent of their wealth in non-cash assets that can be used for planned giving. Most nonprofits ask only for current gifts of cash and are barely scratching the surface of their donors’ true capacity for generosity.

MYTH #5: I need to understand the financial terms in order to start these conversations.

I snuck out the back of the room during my first planned giving seminar — yes, me! The presenter was explaining a tax regulation that had just gone into effect and I felt like a fish out of water. The lengthy words being used as easily as “thank you” and “annual appeal” flew over my head. All I could think was, “If I don’t leave I’m going to completely give up on my fundraising career!” So I left.

Unfortunately, this is an all too frequent response to legacy giving and it’s unnecessary. Like I said at the beginning of this article, professional advisors are better equipped to handle more complicated legacy gifts. According to planned giving expert Dr. Russell James, fundraisers need to talk about legacy gifts in terms that donors understand, which are terms you understand!

I began to feel confident inviting legacy gifts when another fundraiser introduced me to these simple terms for the three basic types of planned gifts:

- Give Later. Give later gifts are the most common legacy gifts — 80-90% of legacy gifts are give later gifts. Give later gifts are assets donors can control during their lifetime and plan to give at death. These are usually given through will or a beneficiary donation.

- Give Now. Give now gifts provide immediate income to receiving organizations but they are invested to provide future revenue. These include donor advised funds and endowments that can make distributions to nonprofits in perpetuity.

- Give & Receive. These gifts allow the donor to make a gift now, personally receive an income, and then provide a remaining gift typically at the end of the donor’s life. When we hear about charitable gift annuities or charitable trusts, these are the types of gifts that provide an income.

If you can talk about legacy giving in these simple terms you have everything you need to begin a legacy giving conversation with your donors that they will appreciate and understand.

How Dave Coker Changed the Future of His Organization and You Can Too

“Nebraska Lutheran Outdoor Ministries(NLOM) was very small when I started inviting legacy gifts,” shared Dave Coker. “I started by adding ‘are you willing to remember NLOM in your will or estate plan?’ to any communication we sent out. At the time we were working with our church body’s Foundation. So when someone said they were interested we introduced them to the Foundation’s planned giving officer.”

“After a few years, the legacy giving program had traction so we made a plan to reach $20 million expectancies by 2020. Our prime prospects were individuals who had given many gifts, so we also decided to focus on building our monthly donors club. As we increased our number of consistent donors we also increased the amount of people we could start legacy giving conversations with.”

“It’s 2023 and we have reached $30 million of bequest gift expectancies. This work is worth the investment!”

You don’t have to be part of a large nonprofit, have a multi-person development staff, or understand all the laws and fancy terms to begin good legacy giving work. You need to invite donors to clarify what they would like to pass on and use terms they will understand. Most importantly, you need to start.

If you are ready to start your legacy giving journey and would like some expert guidance, schedule a call with us HERE.

The article was co-authored by Brenda Moore, CFRE and Samantha Roose.