Hit Your Fundraising Goals with These 5 Annual Planning Steps

Jun 20, 2024

Most nonprofits have an annual fundraising plan. Even so, not all organizations hit their fundraising goals on time or by year-end.

So what’s the difference between the organizations that hit their goals on time and the ones that don’t?

The difference is the kind of annual fundraising plan they create and use.

One of the best ways to reach your fundraising goals on time is to have a simple and strategic fundraising plan.

In this article, you’ll learn the exact five steps our clients have used to create and implement annual fundraising plans that have allowed them to hit (and exceed) their goals on time. You’ll also discover the five most common fundraising planning mistakes so you can avoid them.

Ready to fundraise more effectively and efficiently? Keep reading!

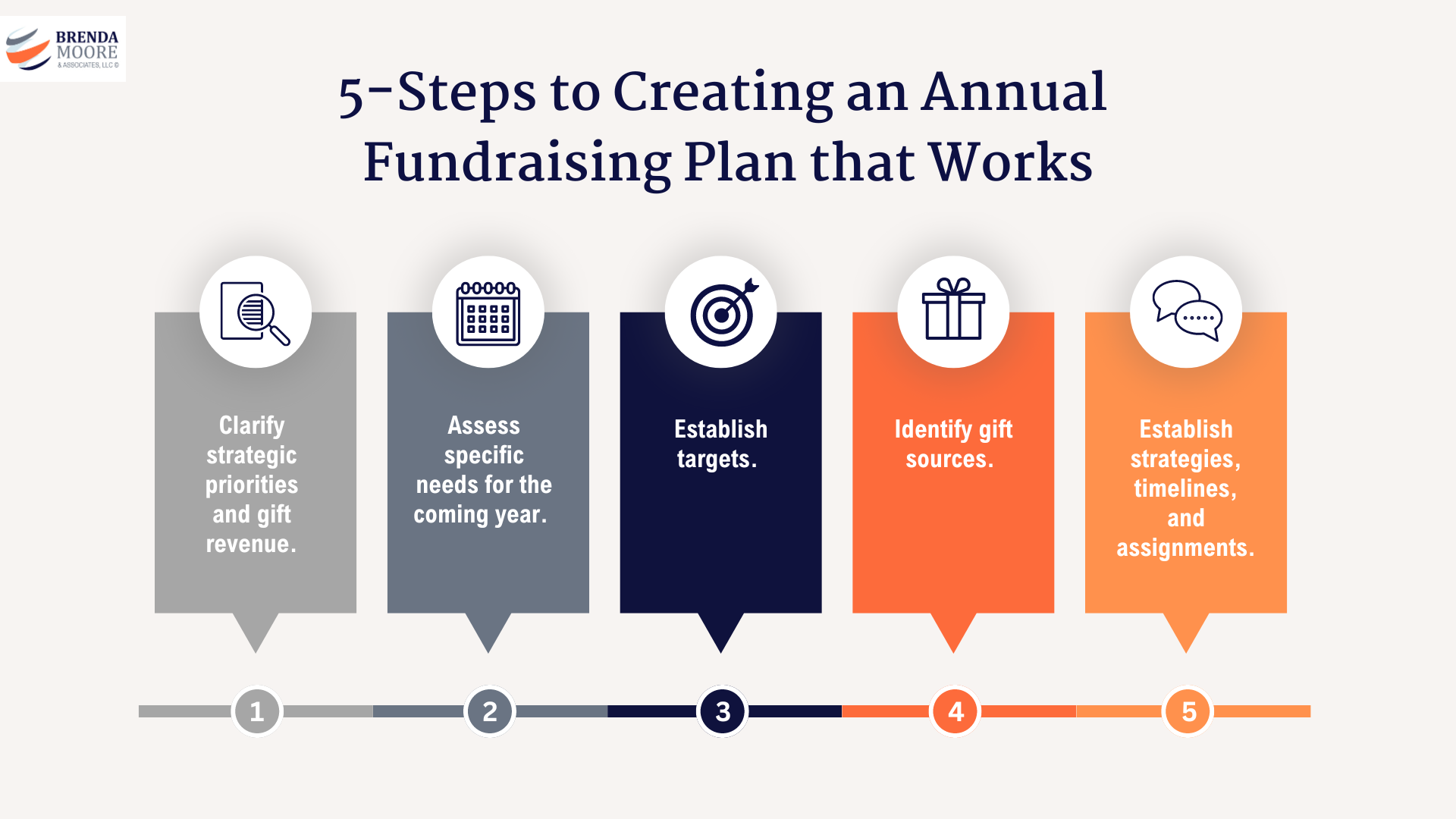

The 5-Step Annual Fundraising Plan System

Fundraising progress is easier to achieve and see when you have a proven plan in place. This is exactly what Nick Tofteland found when he implemented the 5-Step Annual Planning system at Minnehaha Academy.

He said, “We saw results in year one, but we saw tremendous growth in year three. At any given time I was able to break our goals down into three simple questions: How much? For what? From whom? This simple specificity allowed my team to methodically and strategically hit our fundraising goals on time.”

When you’re finished with the five steps you will have outlined the dates, dollars, deadlines, and doers needed to reach your goal.

STEP #1: Clarify strategic priorities and gift revenue.

Ministry organizations that are financially stable over the long term and grow their impact start their annual fundraising plan with strategy.

The purpose of this step is to connect the big strategic goals your organization has with the gift revenue required to meet those goals. These are usually three-to-five-year goals and may look something like this:

- Double the number of people served. Over 3 years, the budget needs to increase by $X.

- Increase impact by establishing a new program. Over 3 years, $Y.

- Securing future impact by growing endowment funds. Over 3 years: $Z.

If these are your goals and the gift income required, you need to plan for raising $X+Y+Z over the next three years. These specific three-year goals guide your planning for the current or coming year's goals and set the stage for the next four planning steps.

STEP #2: Assess specific needs for the coming year.

Based on your three-to-five-year goals, your second step is to define what needs to happen this year. I recommend having a clarifying conversation with your CEO and CFO around these five questions:

- What funding do we need minimally this coming year to realize our most basic strategic priorities?

- What additional funding do we want this coming year to move us even further toward those priorities?

- What non-gift income (i.e. program fees) and endowment distributions are projected to fund these needs and wants?

- Which needs/wants can be best positioned as restricted or budget-relieving giving opportunities to donors who might make larger gifts to solve specific problems?

- What does this mean for the gift income goals we should establish for unrestricted, restricted, and endowment/legacy giving during the coming year?

At the end of this step, you should be able to say, “If we reach $ABC by the end of the coming year we will be on track to raise $XYZ for our strategic three-to-five-year priorities.”

The completion of these first two steps should establish shared ownership of your goals with your organization’s chief decision-makers. That same ownership is established with your development team throughout the following three steps.

STEP #3: Establish targets.

Now that you and your ministry decision-makers have clarified organizational goals, it’s time to make a game plan with your team to hit your annual fundraising goals.

During this process, you establish two things:

Dollar targets for the three most essential forms of gift income:

- Unrestricted gift income. These gifts will fund your operational budget.

- Restricted gift income. This income usually funds specific programs or projects.

- Endowment gift income and legacy gift expectancies. This income ensures the sustained flourishing of your ministry.

Number and percentage growth targets for the most basic measures of donor pipeline health:

- Donor retention. The donors you keep from year to year.

- Donor acquisition. The new donors supporting your organization.

- Major donors. The approximate 10-20% of donors that provide 80%-90% of revenue.

- Legacy donors. Those who establish a planned gift or fund an endowment.

The results of this conversation should answer the question: How are we going to take our big annual goal and make it realistic — something we can imagine accomplishing?

There's nothing wrong with this step being heavily informed by your past performance on these measures. But what you know of your donor’s capacity to give should also inform your decisions.

STEP #4: Identify gift sources.

Now that you know your target numbers, you're going to identify gift sources, constituency segments, and specific prospects needed to reach those numbers. Ask these questions for each goal:

- Which sources of income will fund each goal? (e.g. individuals, organizations)

- Which constituency segments will we target? (e.g. alumni, foundations)

- Which specific prospects are most ready/able? (e.g. 50-year reunion class, XYZ Fund)

Pre-identifying source and constituency segments will allow you to look at your annual plan and take immediate action. This is a critical step to making your annual plan actionable and eliminating overwhelm.

STEP #5: Establish strategies, timelines, and assignments.

Finally, it’s time to dive into the nitty-gritty. This step includes assignments, timelines, and strategies for each source and segment you created in step #4. When you’re finished with this step you should have answers to three questions for each goal:

- What needs to happen in relation to each of the prospect segments to achieve our fundraising goal?

- What day will specific mile-markers toward this goal be completed by? (I recommend monthly mile markers.)

- Who is responsible for completing these tasks?

Don’t peter out as you map out this step! Take the plan to the finish line and remember: this is a working document that you will make adjustments to continuously. Even imperfect tasks and deadlines give you a starting point.

Download the One-Page Annual Fundraising Plan Template

In this template, you will find a space and title for everything you need to include in your annual fundraising plan (download it HERE). Better yet, it’s only one-page! The goal is to keep the completed template on one page.

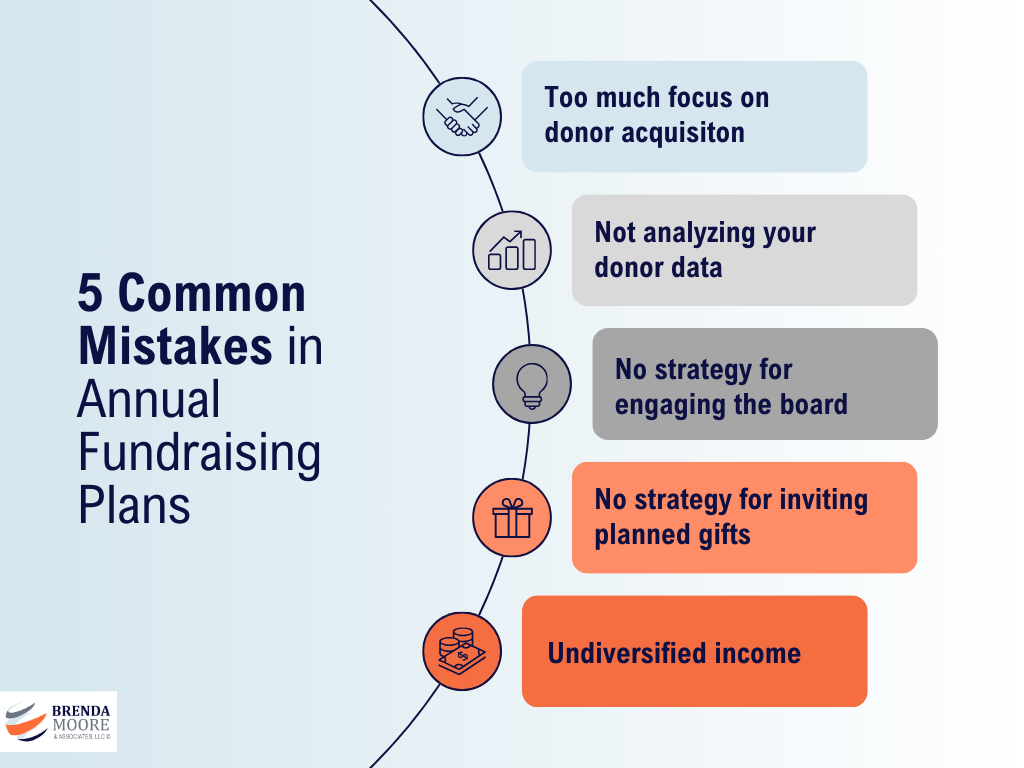

5 Fundraising Plan Mistakes and How to Avoid Them

After walking alongside countless organizations we can confidently tell you that most nonprofits spend too much of their fundraising effort on the wrong things.

In this next section, you’ll learn five common fundraising mistakes so you can avoid them!

Fundraising Mistake #1: Too Much Focus on Donor Acquisition

Retaining donors provide organizations with dependable income and a list of people they can reach out to with gift invitations. Unfortunately, most organizations focus their plans on acquiring new donors instead of creating systems to retain current donors.

This is costly to nonprofits for two reasons:

- According to CCS Fundraising, 48% of donors take five years to make a major gift. Your largest gifts will provide at least 80% of your gift revenue, so you typically need to retain donors for 5+ years before these friends are ready to make these gifts.

- It costs 5 to 10 times more to acquire a new donor than to invest in an ongoing relationship with a current donor. Investing in a relationship with a current donor saves money and cultivates a relationship that could lead to a major gift.

Retaining donors will save organizations money in the short term while paving the way to larger gifts in the future.

Fundraising Mistake #2: Not Analyzing Your Donor Data

Analyzing your donor data will allow you to observe trends, assess the effectiveness of the strategies you’ve used in the past, and better project your growth for the future.

This data reveals donor giving habits including donors acquired, retained, and upgraded. This information can help you identify the best prospects and strategies for reaching or exceeding your fundraising goals by the end of the year.

You can begin assessing your fundraising strengths and weaknesses by analyzing your donor data today with a free software called Fundraising Report Card.

We highly recommend you enlist the support of a consultant who can help you interpret the data and dig deeper into your donor records. Learn more about working with our consultants HERE.

Fundraising Mistake #3: No Strategy for Engaging the Board

Too many nonprofits haven’t found success in engaging their Board members in fundraising, so they make the mistake of leaving these critical volunteers out of their annual plan entirely.

Your Board members want to do meaningful work for the sake of your organization. In fact, it’s their legal duty to ensure the financial well-being of your nonprofit. But they usually don’t know how to do good fundraising work without your help.

Download the Top 10 Super Simple Ways for Board Members to Engage in Fundraising HERE. And then build these strategies into your Annual Fundraising Plan with your Board members assigned.

Fundraising Mistake #4: No Strategy for Inviting Planned Gifts

Introducing the idea of planned giving to your donors is crucial for three reasons:

- Larger gifts. Unless you introduce the idea of making planned gifts, which usually involve a donor’s assets, most donors will give from their cash. This limits what they can give because on average only 10% of a donor’s wealth is held in cash, while 90% of their wealth is in assets.

- Growth in current giving. Research done by Dr. Russell James shows that nonprofits focused on non-cash gifts from assets grew 66% while nonprofits only receiving cash gifts grew by 11%.

- The Great Wealth Transfer is here. Currently, 45 million households are cumulatively passing on $90 trillion from one generation to the next! Cerulli Associates estimates that $10-$12 trillion of that will go to charity.

You can begin introducing planned giving today with the “Have You Remembered” ad. It’s my clients’ favorite way to regularly introduce legacy giving. Download the ad and guide HERE and customize it as needed!

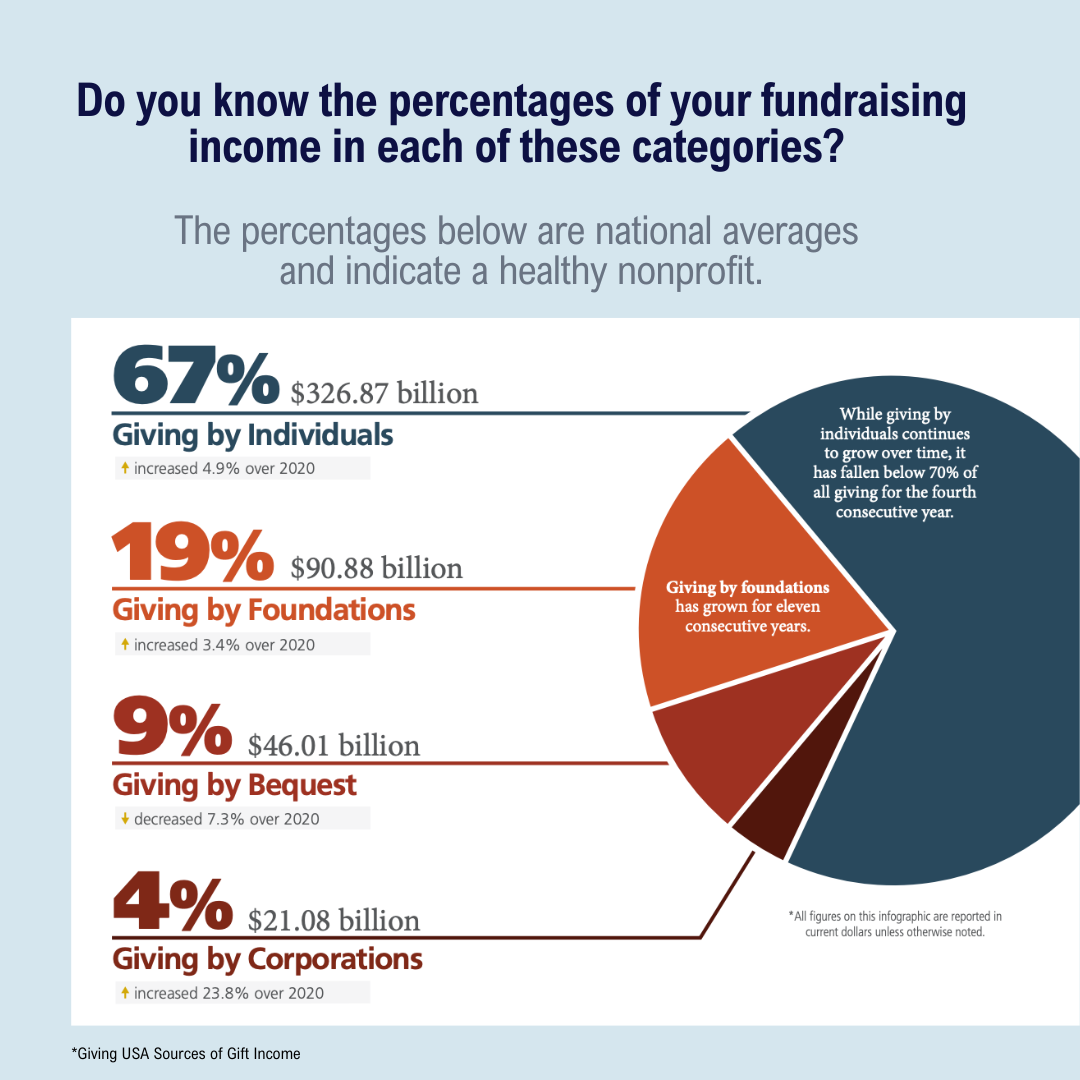

Fundraising Mistake #5: Undiversified Income

Your nonprofit may be one of the many that have revenue from program fees and government contracts in addition to charitable gift income. But other organizations like churches and ministries depend almost entirely on gift income.

In order to build a sustainable charitable gift revenue model — whether gift income is 10% or 100% of your financial model — it’s critical that you include strategies and tactics in your annual fundraising plan for:

- Inviting gifts from assets. If you are not planning to invite gifts from stock, retirement plans, donor-advised funds, and other noncash assets, you are missing out on most of your donors’ potential. See Fundraising Plan Mistake #4.

- Inviting gifts to your endowment. If distributions from a healthy endowment could fund even 10% of your organization’s budget, you’d have a healthier revenue mix and a safety net to mitigate the ups and downs of other revenue streams.

- Inviting bequests. Each year, 9% - 10% of all charitable gift income in the US is received by bequest — gifts that people leave at death. If you’re not receiving this 10% slice of the income pie, you’re missing out on the Great Wealth Transfer. Again, time to get serious about Fundraising Plan Mistake #4.

Just like you wouldn’t put all your money into one volatile investment, organizations shouldn’t be dependent on too few streams of income. Including these strategies in your annual fundraising plan is a simple way to begin diversifying you revenue.

Time to Create (or Update) Your Annual Fundraising Plan

A simple and strategic annual fundraising plan is one of the best ways to hit your goals on time (or exceed them). Here are two different starting points for putting the information you just learned into action:

- Download and print the one-page template if you haven’t already.

- Do you already have an annual plan? Start plugging your current goals into the one-page template and assigning them monthly milestones and point-persons.

If you still feel like you don’t know where to start or you want a decision-maker on your team to understand this system, schedule a call with us HERE.

We believe in this system tremendously because we’ve seen it transform the financial stability and longevity of the organizations we’ve worked with. We would love to answer any questions you have or help you implement it for your organization.

Co-authored by Brenda Moore, CFRE and Samantha Roose.