Two New Reports Shed Light on Unlocking the Power of Recurring Donors

strategic planning Jul 27, 2023

|

This article was written by Dave Raley of Imago Consulting. It was originally published on The Wave Report on July 14, 2023. Sign up to receive future Wave Reports here. A couple of reports recently highlighted two related trends valuable to leaders as they seek to grow recurring revenue streams.

Let’s unpack. The value of recurring donors is increasing.

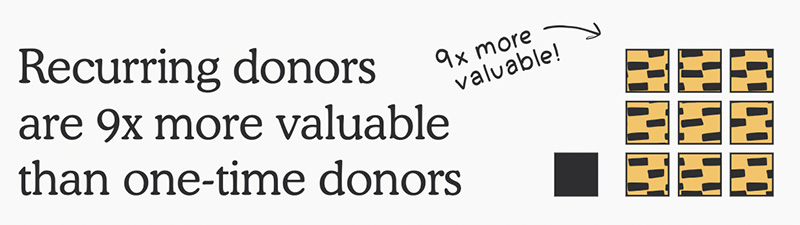

The Classy team found in their data that recurring donors were, on average, 9X more valuable than one-time donors. |

|

Above: Classy’s report on The State of Modern Philanthropy 2023 found that recurring donors were 9X more valuable in terms of long-term donor value. |

|

Using this new data, that same $300 one-time donor to a nonprofit would see a value of $2,700 from recurring donors. This has significant implications regarding how much a nonprofit should be willing to invest in acquiring and cultivating recurring donors. If a recurring donor is worth 9X that of a single gift donor, the amount of effort and investment a nonprofit can and should put into acquiring and converting donors to recurring should increase. 💡 Takeaway: If subscription donors are worth upwards of 9X that of one-time donors, then nonprofits can stand to invest more significantly in the acquisition and conversion of those donors. Are you willing to spend nine times the cost to acquire a one-time donor to obtain and keep a monthly subscription donor? Acquiring new donors as monthly subscription donors from the first gift is the dream.

|

|

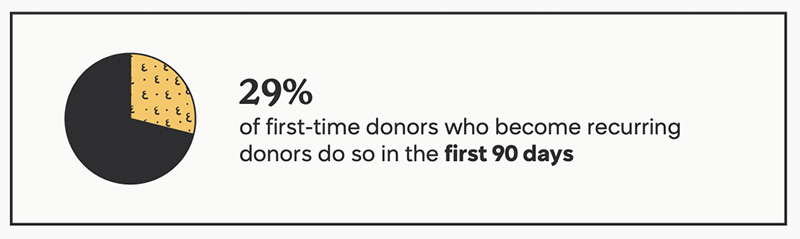

Above: The first 90 days is a critical stretch to acquire and convert monthly donors. |

|

This has implications for the long-term value of donors but also lowering the initial costs of cultivation and conversion, so it’s a win on both sides – increasing revenue, and decreasing cultivation costs. Even better than converting a donor in the first 90 days is starting with new donors giving monthly, right from the first gift. In my experience, I’ve seen 25% of new donors to a nonprofit come in with their first gift being monthly. This is saying nothing of the sponsorship or membership nonprofits, who often see the majority of new donors start as recurring. Classy points to a couple of example organizations that have managed to build 66% and 64% of their annual revenue on recurring donation volume, respectively. 💡 Takeaway: The ideal strategy is to acquire donors as subscription givers, giving monthly from the first gift. After that, the first 90 days is a critical time of opportunity to convert donors to recurring. This requires understanding the audience of potential donors and cultivating strategies that result in first gifts as recurring subscription gifts. Subscriptions are now universal.

|

|

Above: A 2023 Subscription Commerce Industry Outlook study found that 95.8% of all U.S. Adults have at least one subscription. |

|

Reports over the last few years found that most consumers had at least one subscription, but this new report confirms what I’ve seen as I’ve spoken about the Subscription Economy – subscriptions have become a near-universal phenomenon. 💡 Takeaway: Now that 96% of U.S. adults have at least one subscription, this means virtually the entire population of potential donors has at least some comfort level with discretionary monthly recurring transactions. This key consumer trend has warmed donors up to the idea of discretionary monthly donation subscriptions. Subscriptions are seeing a correction from the pandemic period (i.e., the value of subscriptions is paramount).

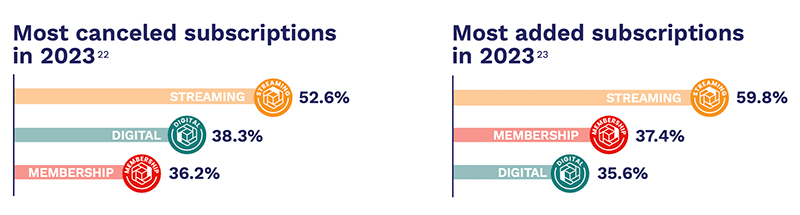

52.6% of U.S. Adults canceled a streaming service subscription in 2023, contrasted with 59.8% who added a subscription to a streaming service. In other words, subscriptions are much more sensitive to cancellation in the consumer world. |

|

Above: Consumers are ready and willing to cancel subscriptions that don’t add value and are just as likely to add them. It’s all about the current value proposition. |

|

Consumers aren’t willing to pay on an ongoing basis for subscriptions that don’t have a strong ongoing value proposition. 💡 Takeaway: If you are a nonprofit, your subscription donors should be more resilient than the typical consumer subscription. However, you also would do well to consider what your ongoing value proposition is to your donors in a subscription-driven world. Are you regularly affirming donors? Showing them the impact and value of their ongoing giving? Providing ongoing value? We continue to be optimistic about nonprofits’ ability to tap into the subscription economy and build significant recurring revenue, especially as donors display a willingness to give or “subscribe” to the causes they care most about. Until next week… Surfs Up! 🌊 - Dave This article was authored by Dave Raley for the Wave Report and republished here with permission. The Wave Report is a weekly report on the trends and lessons leaders can learn. You can subscribe for yourself at www.imago.consulting/wavereport. |