From Surviving to Thriving: 7 Signs Your Nonprofit Needs a Legacy Giving Plan

Aug 22, 2024

Do you find yourself spending a lot of time fundraising for urgent needs?

If so — you may have already realized this — the tyranny of the urgent feels like being stuck on a hamster wheel.

But what if you could build a stable financial future for your ministry or nonprofit while addressing today’s critical fundraising needs?

How freeing would it be to know that your fundraising efforts are…

…creating funds that will provide 10% or more of your annual budget no matter what?

…growing your organization's impact by 6Xs over the next five years?

…cultivating lasting and meaningful relationships with donors?

It would feel so freeing! And guess what? You can do all of that while addressing your current needs by starting a legacy giving program!

The next question is: how do we know if it’s time to focus on more than just the urgent?

That’s exactly why we wrote this article. Keep reading and you’ll discover 7 key signs indicating your organization needs (and is ready to start) a legacy giving program.

Sign #1: My loyal donor died, and our nonprofit wasn’t named in their Will.

In the event that a loyal donor passes without writing you into their Will it’s probably because they assumed you didn’t want or need a Will-made gift. This is disappointing, but a donor’s assumption probably happened because you made a few assumptions, too.

Incorrect assumptions are one of the most significant roadblocks in major and planned gift fundraising.

- Just because loyal donors give regularly doesn’t mean they are aware that writing you into their Will is an option or something that would help the organization.

- Just because a donor doesn’t appear to have wealth doesn’t mean they don’t have the capacity to make a large one-time gift or write you into their Will.

- Just because a donor has children doesn’t mean they don’t have the desire to remember the nonprofits and ministries they also love.

When I’m coaching my clients on their work with a donor, they will often hear me ask them, “Is that what the donor actually said?” It’s easy to incorrectly read between the lines and jump to conclusions. A simple way to make sure you’re not saying no for your donors is to ask yourself, “Is that what they actually said?”

If they didn’t actually say…

…I don’t want to include your organization in my Will.

…I don’t have the capacity to make a larger gift.

…I want to leave what little will be left for my children.

Ask them. More often than not, you’ll be surprised by your donors’ interest and willingness to at least consider writing you into their Will. Learning how to have these careful and sometimes, even holy conversations, is one of the most helpful gifts you can give to your donors.

Sign #2: During the past month, no one has said “You’re in my Will.”

Only 6% of Americans name a charity in their Will. But one in three American donors have said they would consider doing so if asked.

Statistically speaking, if you have 1000 donors, at least 60 of them would likely include your organization in their Will — if invited!

You should regularly hear donors tell you, “You’re in my will.” If you’re not hearing this at least once a month there are probably three reasons why:

- You’re not regularly talking about Wills in your communication.

- You’re not sharing stories of donors who have written you into their Will.

- You’re not inviting your donors to include you in their Will during donor visits.

You are up close to your organization’s needs on a daily basis. Your donors aren’t. They are up close with their needs and their loved ones' needs. The thing is, your nonprofit might actually be one of their loved ones. Even if they’re giving to you regularly, they might not know they could be making a significant impact by writing you into their Will.

So it’s up to you, through regular communication and clear asks, to educate your donors about including you in their Will.

Wondering what the best words to use are when talking about Will-making? Here are two of our clients’ most-loved resources for initiating and navigating legacy giving conversations: Words That Work webinar replay and Strategies for Receiving More Legacy Gifts in 2024 (scroll to the communication section).

Sign #3: More than 20% of our donors are 65 or older.

When most nonprofits realize that their donor base is aging, they focus their energy on donor acquisition. That definitely should be part of your strategy. However, there is incredible future and current gift potential for nonprofits that intentionally cultivate relationships with their baby-boomer donors.

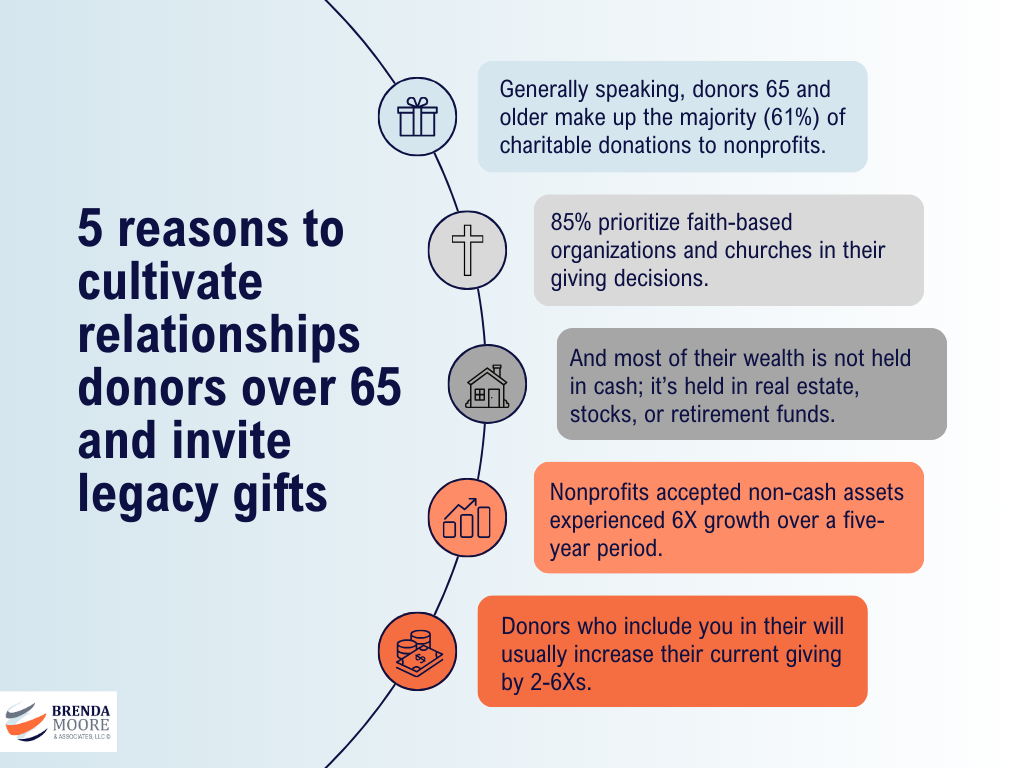

Here are five reasons why you should prioritize cultivating relationships with and inviting legacy gifts from your donors who are over 65:

- Generally speaking, donors 65 and older make up the majority (61%) of charitable donations to nonprofits.

- 85% are loyal to specific causes or organizations and prioritize faith-based organizations and churches in their giving decisions more than any other nonprofit.

- And most of their wealth is not held in cash; it’s held in real estate, stocks, or retirement funds.

- According to research by Dr. Russell James, “Nonprofits accepting non-cash assets saw 66% revenue growth over a five-year period compared to those accepting only cash.”

- Donors who include you in their will usually increase their current giving by 2-6Xs.

As donors near and enter the last third of their lives, providing resources for their loved ones and their most closely-held values becomes a priority. Cultivating a meaningful relationship with your donors and helping them through the process of Will-making can be one of the most thoughtful ways you serve them.

Sign #4: Less than 10% of our gift income comes from gifts through Wills.

While giving from some other sources is decreasing, giving through bequests is staying steady.

Giving USA 2024 reported: “Giving by bequest stayed relatively flat this year but remains a significant piece of the puzzle of total giving. Bequests represent around 8-10% of total giving over the last 40 years.”

The fact that bequest giving has remained steady while other giving fluctuates means you should be inviting these gifts with confidence. Non-cash gifts are the gifts donors want to make. Bequest gifts are made from accumulated assets instead of income. They are the most cost-effective and tax-efficient ways for donors to give.

And there is no higher return on the investment of your time and your organization’s money in developing these gifts. The typical completed planned gift is 200 times the size of a donor’s largest annual fund gift. You can’t afford to not do this work.

An easy way to help your donors begin thinking about these gifts is by adding legacy giving information to your website’s giving page. Luther Seminary provides a great example of this HERE.

Sign #5: Our endowment fund is less than 2X our annual operating budget.

Historically speaking this is one of the best times to build an endowment fund.

Why? Because we are currently living during the Great Wealth Transfer, an economic phenomenon where 45 million households will cumulatively pass on $73 trillion from one generation within 20-25 years! Cerulli Associates estimates that $10-$12 trillion of that will go to charity.

Endowment funds are largely built through legacy gifts. The power of an endowment fund is its reliability as an additional source of income. For example, if you have two times of your annual operating budget in an endowment fund and the endowment annually distributes 5% of its value to your organization, you have a dependable source for 10% of your funding. These distributions often provide a safety net in lean years and seed money in other years.

In Legacy Giving: The Basics, our self-paced online course, and six-week group coaching program, we walk participants through the specific procedures and protocols for establishing, growing, and stewarding endowments. Our participants often tell us it’s one of the most helpful things they learn.

Check out the course and join the next round of group coaching HERE.

Key #6: We don’t have a strategy for inviting gifts from IRAs, DAFs or stock.

If you don’t have a strategy for inviting IRAs, Donor Advised Funds, or stock now is the time to start. Why? Because these types of gifts have the power to provide gifts both now and in the future.

Here are three assets that can create gift income now and later.

- Gifts from IRAs allow donors to make a non-taxable Qualified Charitable Distribution (QCD) from their account beginning at age 70½. They may also name a charity as a beneficiary of the IRA’s remainder value, also without paying any tax.

- Gifts of stock create incredible tax advantages for donors when gifted directly to a nonprofit. And in almost every state, your brokerage can help you name a nonprofit as a transfer-on-death beneficiary.

- Donor Advised Funds are the fastest-growing charitable giving tool. Donors establish DAFs with current gifts, and then direct gifts from the DAF to their favorite charities. These DAFs can make final distributions to charities at the end of the donor’s life, or they can continue to distribute gifts to charity beyond the donor’s life.

Gifts from IRAs, stock, DAFs, and also real estate can be in the best interest of your donors and also become enduring lifelines for your ministry or nonprofit. In fact, FreeWill’s research indicates that nonprofits receiving non-cash gifts grow 6Xs faster than nonprofits receiving only cash.

Inviting and securing these gifts means a significant portion will come to you later, but your annual giving revenue will increase at the same time.

Sign #7: I haven’t named my favorite ministries or nonprofits in my own Will.

Your planned giving work will go so much better if you can authentically invite others to join you. It’s really hard to help others do something you’re not willing to do. Additionally, planned gift conversations will be so much easier to navigate if you have your own experience to lean on and your own story to share.

Planning your own gift has four steps.

Step 1: Learn more about your giving options.

Of course, you can do the research yourself, but the easiest option would be to befriend an experienced gift planner or listen to Legacy Giving: The Basics at your own pace.

Step 2: Review your current estate plan.

Work through the Estate Planning Checklist provided in our Legacy Giving: The Basics course. Its front page helps you make sure your current estate plan is up to date and supports your values. Its back side is for individuals who do not have an estate plan and are starting from scratch. You can replicate these tools with your own organization’s branding.

Step 3: Plan your own gift.

This includes multiple steps and meetings with several different professional advisors.

- A Gift Planner who might be working for a community foundation or a larger nonprofit you may already support.

- A Financial Planner who can help confirm that your gift plan aligns with your long-term financial plans.

- An Accountant who will help you evaluate any tax benefits or ramifications.

- An Estate Planning Attorney who will make sure all the legal documents are drawn up and your plans are made official.

This work can take a matter of weeks. For others, especially if you have a complicated estate, this could take a significant amount of time and become quite a journey.

Step 4: Confirm and document your own gift plan.

The completion of this work is something to celebrate! Meet with the organizations your planned gifts will bless and share your good news with them.

Your First Step to Starting a Legacy Giving Program

If you resonate with four or more of these seven signs, a legacy giving program could transform your ministry or nonprofit.

Legacy Giving: The Basics is self-paced online course demystifying legacy giving. You’ll receive actionable steps and customizable resources with each module. Purchase of the course gives you access to periodic group coaching where you can receive personalized feedback from our consultants. Register or learn more HERE.

Co-authored by Brenda Moore, CFRE and Samantha Roose.