Unlocking the Power of DAFs and IRAs for Your Organization’s Financial Future

Oct 24, 2024

Mark, a nonprofit leader and pastor, spent most of his time focused on urgent needs—keeping his organization afloat, meeting immediate demands, and stretching every dollar just to make it to the next quarter. Long-term planning always seemed like a luxury he couldn’t afford.

Sound familiar?

But everything changed for Mark when he discovered the untapped potential of gifts from Individual Retirement Accounts (IRAs) and Donor-Advised Funds (DAFs)—gifts that could provide both immediate support and secure his organization’s future. Initially, the idea of inviting these types of gifts seemed overwhelming. But then Mark had a breakthrough.

He realized that many of his donors already owned IRAs or gave through DAFs. All he needed to do was educate them about the possibilities and invite them to make transformational gifts.

He didn’t need to be a financial expert—just offer basic education.

Once he started these conversations, the response was immediate. His most loyal donors even went a step further, naming the organization’s Endowment Fund as the beneficiary of their IRA or DAF, securing future gifts for years to come.

Mark’s success didn’t come from overhauling his entire strategy. It came from simply educating his donors and extending invitations to use assets that could provide gifts now and later.

If you're ready to do the same for your organization, this article will show you how to start.

The Power of DAFs and IRAs for Nonprofits

When one of my friends was a child she experienced a memorable scare walking to the bus stop. It was a foggy morning. As soon as her family’s mail box came into view she saw it… A blue hairy monster.

She ran inside and told her mom, who promptly sent her back outside. Two more times this happened. Finally my friend’s mom decided to walk with her so she wouldn’t miss the bus.

At the mailbox they both saw it—the neighbor’s goat eating grass. Even though my friend was familiar with the goat, when she saw it in the fog and didn’t understand what it was, the goat was a scary monster.

When it comes to fundraising, Donor Advised Funds (DAFs) and Individual Retirement Accounts (IRAs) are somewhat familiar words. But the financial and legal terms they’re associated with can be hard to understand and quickly turn them into scary monsters.

Fortunately, like the hairy monster that turned out to be a friendly goat, DAFs and IRAs can be explained in common words and are one of the easiest ways for donors to make both current gifts and future legacy gifts.

What are DAFs?

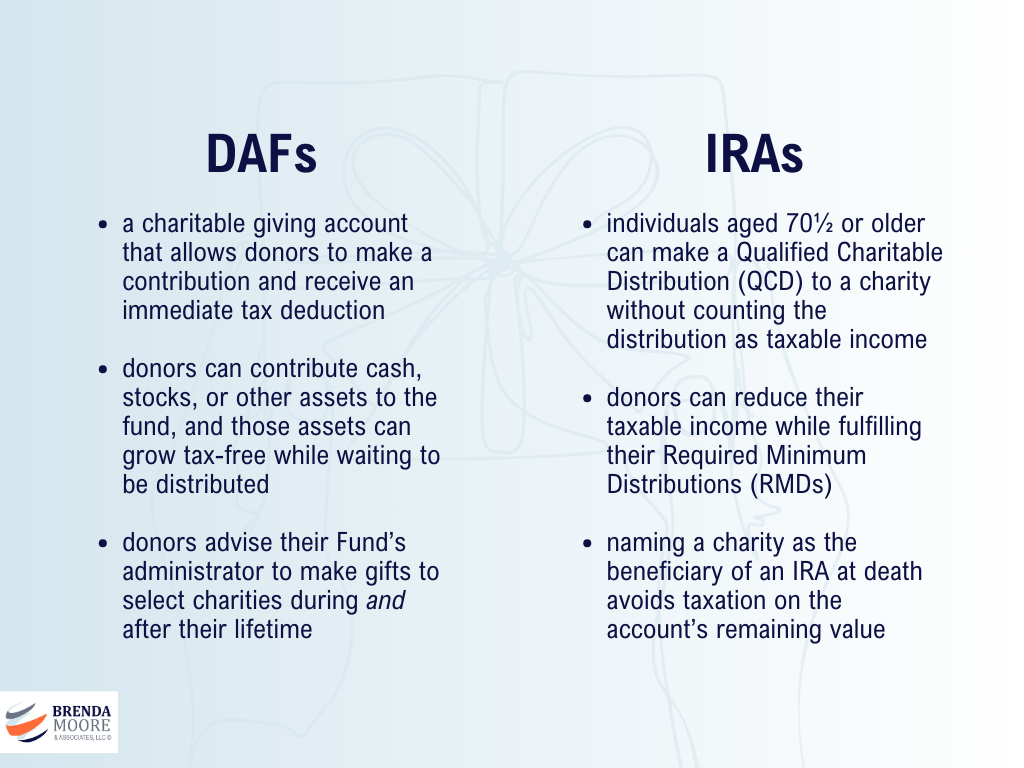

A Donor-Advised Fund (DAF) is a charitable giving account that allows donors to make a contribution, receive an immediate tax deduction, and recommend grants to their favorite nonprofits over time.

Donors can contribute cash, stocks, or other assets to the fund, and those assets can grow tax-free while waiting to be distributed.

And contrary to popular belief, you don’t need to be a person of great wealth in order to establish a DAF. Some sponsoring organizations have no minimum gift amounts required to establish a fund. Others require minimum gifts as low as $2500 or $5000.

Most individuals who establish Donor Advised Funds do so because:

- DAFs give donors the opportunity to take charitable tax deductions and avoid paying capital gains tax. This is usually triggered by a significant financial event in the donor’s life like an inheritance, an unanticipated bonus, the sale of a stake in a family business, or the vesting of stock options.

- DAFs don’t require immediate distribution to charities. Donors can delay their charitable giving decisions if they need more time to consider their priorities, or they can continue to grow the fund through investments and additional contributions until they are ready to make a much larger gift.

- DAFs create efficiencies in terms of managing charitable contributions. The DAF administrator invests the fund, and it grows tax-free. The Administrator vets and qualifies the charities, writes the checks to the charities, and the donor receives just ONE receipt they can use for tax purposes.

For most nonprofits, Donor Advised Funds have become one of their fastest growing sources of current gifts. In fact, the 2023 Donor Advised Fund Report showed a 9% increase in DAF gifts from the previous year, mounting to $52 billion granted funds and almost 2 million accounts. The report went on to say that DAF popularity is expected to continue increasing.

How are IRAs used for charitable giving?

An IRA, or Individual Retirement Account, is a tax-advantaged savings account that helps people save for retirement. IRAs make up roughly 35% of total US retirement assets. More than 4 in 10 US households own IRAs.

Assuming that more than 4 in 10 of your donors own this asset, you may want to get instantly serious about understanding its power for charitable giving!

When owners begin taking withdrawals from most types of IRAs, they must pay tax on that income. IRA owners must eventually begin taking Required Minimum Distributions at certain ages.

However, the IRS allows individuals aged 70½ or older to make a Qualified Charitable Distribution (QCD) directly from their Individual Retirement Account (IRA) to a qualified charity without having to pay tax on the income.

These gifts are incredibly easy for IRA owners to direct.

- The IRA owner/donor instructs their account’s custodian to make a specific distribution to a specific charity(s).

- The donor alerts the charity(s) that a distribution is forthcoming.

- The account’s custodian sends the distribution directly to the charity(s).

For most nonprofits, QCDs from IRAs have become another one of the fastest growing sources of current gifts. Within a few years of this gift option becoming permanent under the law, QCDs received by nonprofits nearly tripled. Since then their popularity among donors has continued to increase.

The Future Gift Power of DAFs and IRAs

No doubt about it, DAFs and IRAs have the power to significantly increase current giving to your nonprofit or ministry. Don’t leave this powerful funding on the table—if you don’t have a strategy for inviting current gifts from these sources, schedule a no-cost consultation here to start the process.

But the true superpower of DAFs and IRAs may be their potential for future legacy gifts AND their power to jump-start your legacy giving program.

From a donor’s perspective, they typically begin making distributions from DAFs and IRAs to solve their current tax problems. But they may not have considered their benefits for solving future tax problems, much less their potential for leaving a generous legacy gift for a ministry they love.

From a nonprofit’s perspective, you should see your DAF and IRA donors as the wiggly, excited 3rd grader with a hand raised high. “Ooo Ooo Ooo… Pick me! See me? I have something to share!”

These gifts should be sending you a BIG signal that there’s more where this came from.

Let’s take a closer look at how…

DAFs as Future Legacy Gifts

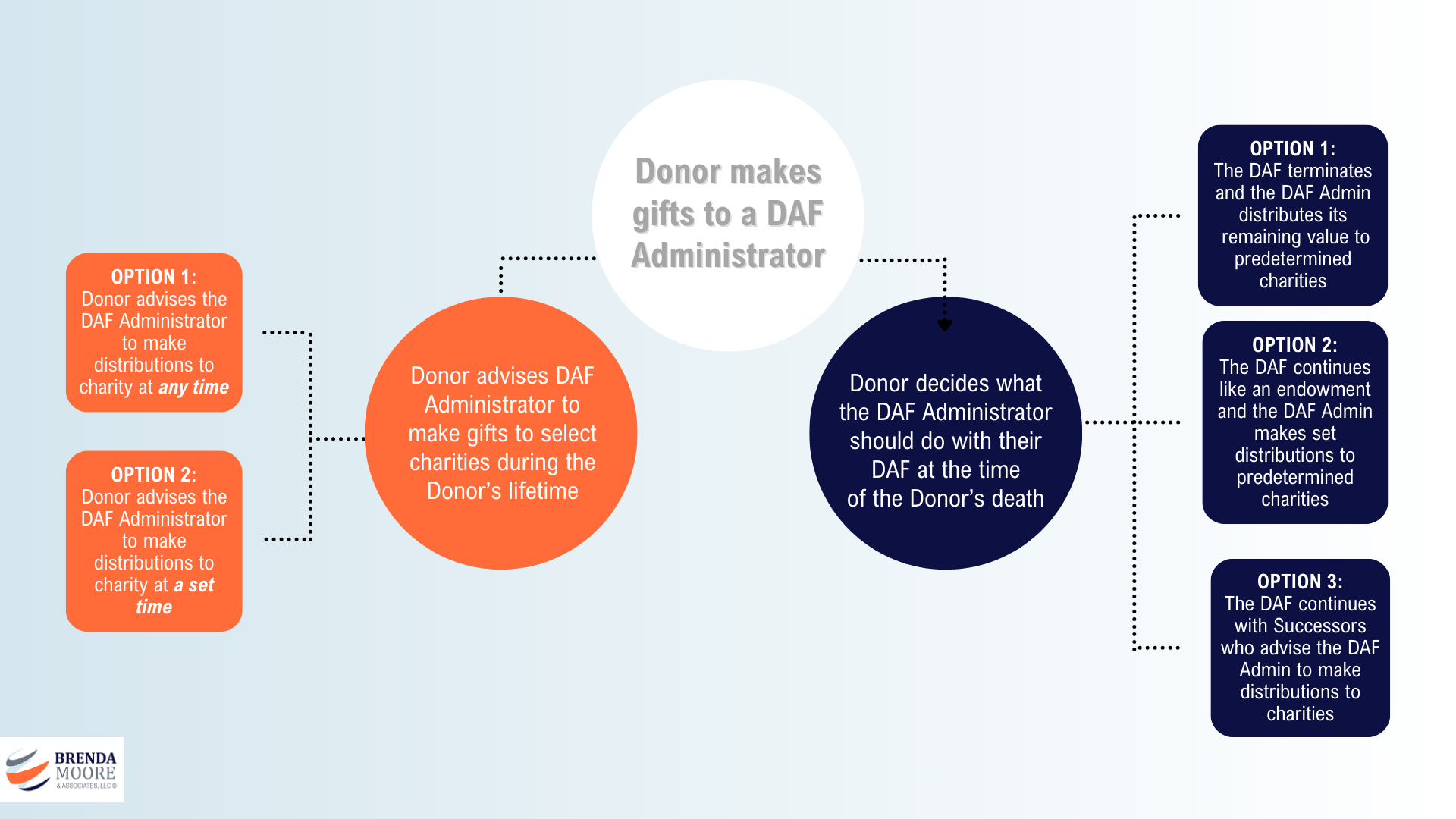

While each DAF Administrator has its own policies and guidelines about the distribution of a DAF after the donor’s lifetime, the most common options are:

- Distribution of the remaining fund value to select charitable beneficiaries. This choice is similar to a donor naming your ministry in their will or beneficiary documents. A donor who makes this choice feels confident in your organization’s ability to steward a larger, final gift.

- This donor may have a specific hope for how your organization will use their final distribution—perhaps a permanent endowment they now establish directly with you. Or they may be happiest knowing that your ministry will receive a larger, final unrestricted gift to support whatever your current priorities may be.

- Most every nonprofit I know wants to help their DAF donors make this choice because it typically results in the greatest financial benefit to the nonprofit.

- If this is the DAF Donor’s choice, this is your signal to continue stewarding the personal relationship with care and helping the donor determine and document their intentions for the ultimate use of the future gift.

- Converting the remaining fund value into an endowment that makes perpetual distributions to select beneficiaries. A donor may prefer to leave the fund permanently invested with the DAF Administrator, entrusting them with the duty to make annual gifts to their pre-selected charities.

- This is often the Donor’s choice when they want to continue supporting your organization on an annual basis, but aren’t fully confident that your organization has the expertise to steward an endowed fund (often seen with very small or otherwise volatile nonprofits).

- This isn’t a bad result for your organization—you continue to receive an annual gift.

- But the assets that fund the gift aren’t in your organization’s endowment fund.

- If this is the DAF Donor’s choice, this is also your signal to strengthen your relationship with this donor, and get more serious about a legacy giving program and an endowment fund that is governed by policies and practices your donors can trust.

- Continuation of the DAF, but with successor advisors. These successor advisors are often the donor’s children. A donor who makes this choice is typically trying to pass on a legacy of generosity to the next generation.

- But your Donor’s children may or may not consider your nonprofit to be their own priority, and future gifts from this DAF could be at risk.

- If this is the DAF Donor’s choice, this is your signal to expand your relationship with the Donor to include their children.

Your Donor’s final plans for their DAF are almost always revocable. Most DAF Administrators allow Donors to make changes to their final distribution plans. It’s your organization’s job—maybe YOUR job—to develop trusted relationships with these DAF donors.

At the very least, your aim should be to stay on their list of charitable beneficiaries. But even better, you can help your DAF donors grow to love and trust your nonprofit, leading them to increase their current distributions and name you as a direct beneficiary of a future distribution.

IRAs as Future Legacy Gifts

Hands down, an IRA is the easiest, most tax-wise way for an IRA owner to make a future legacy gift. Here’s why…

A future gift of an IRA’s remaining value can be made with a simple beneficiary form. There’s no need for your donor to write or update a will or trust in order to make this gift to your nonprofit.

Here are the simple steps you can share with your donors who are IRA owners.

- Download a beneficiary form from your IRA custodian’s website.

- Complete the form, recording the names, tax ID numbers, and percentage distributions for each of the charitable beneficiaries you want to include, in addition to any individuals you want to include.

- If married, secure your spouse’s signature to the form. By law, a surviving spouse is the primary beneficiary of any IRA, and they must consent to the distribution of the fund to any person or organization other than themselves.

- Return the completed form to your IRA custodian and secure their confirmation of the change.

A future gift of an IRA’s remaining value may offer a donor several possible tax benefits.

- Deferred income tax due upon death would be reduced or even eliminated depending upon the proportion of the fund’s remainder that is gifted to charity.

- The total size of the donor’s estate would be reduced by the value of this gift, potentially reducing any estate tax consequences.

- Assets with lesser tax consequences could be gifted to the donor’s heirs, potentially increasing the net value of their legacy gift to them.

If your donor is making current gifts from their IRA—Qualified Charitable Distributions (QCDs)—this is your signal to strengthen your relationship with the donor, begin a conversation about a future legacy gift, and help them understand the benefits and simplicity of using their IRA as a comprehensive tool for charitable giving.

Empower Your Donors and Secure Your Organization’s Future

In conclusion, Donor-Advised Funds (DAFs) and IRAs present an incredible opportunity for nonprofits to secure both current and future gifts, helping to build a sustainable financial future.

By educating your donors, like Pastor Mark did, and making it easy for them to give through these channels, your organization can benefit from a steady stream of support—today and for years to come.

Are you ready to unlock the power of DAFs and IRAs for your nonprofit? Book a no-cost discovery call today to learn how you can tap into these resources and grow your organization's impact.