Transformational Gifts Made Easy: How DAFs and IRAs Empower Donors & Nonprofits

Dec 05, 2024

Are you hesitant to invite gifts from Donor-Advised Funds (DAFs) and Individual Retirement Accounts (IRAs) because the process feels overwhelming or unfamiliar?

The truth is, inviting these gifts is easier than you think—and incredibly rewarding. When you understand how to educate donors about DAFs and IRAs, explain the gift making process, and confidently and tactfully invite these gifts, you can unlock a powerful source of funding for your nonprofit.

This article is the second of a two-part series unpacking the power of DAFs and IRAs for ministries and nonprofits. The first article demystified how these gifts work so that you can feel confident and knowledgeable when talking to donors and inviting these gifts (read it HERE).

In this article you’ll walk through the ease and benefits of DAF and IRA gifts for both you and donors, how to educate your donors about these gifts, and how to invite them!

Why You Should Actively Invite Gifts from DAFs and IRAs

The journey of planning my parents' estate gifts began during one of the hardest seasons of our lives—my dad’s cancer diagnosis. At first, the weight of his illness made these conversations feel overwhelming. But when we shifted the focus to what mattered most to my parents—their values and the causes they cared about deeply—everything changed.

These discussions became less about confronting mortality and more about creating a lasting legacy. My parents had often expressed a desire to make an impact on their favorite ministries by:

- providing significant support during their lives (major gifts) and

- providing sustained support after their lifetime (legacy gifts that would fund endowments).

Talking through the practical steps of how their resources could reflect their priorities brought an unexpected sense of peace and purpose.

During these conversations we explored some more technical gift options like charitable trusts, but the easiest solution—the combined use of an IRA and a Donor Advised Fund—was the easiest thing for them to understand and say "yes" to.

The simplicity and efficiency of DAF and IRA gifts made them the right choice for my parents and will most likely make them the right choice for many of your donors. Here’s why…

- For donors, these giving methods are easy and advantageous. Recommending a DAF grant requires just a few clicks, and naming a charity as the DAF’s final beneficiary usually involves a simple online form. Making a Qualified Charitable Distribution (QCD) from an IRA during life, or directing the IRA’s remainder to charity at death can both be accomplished online. Each of these giving strategies comes with varying tax benefits depending on the donor’s situation.

- For nonprofits, DAF and IRA gifts unlock new funding streams with minimal effort. DAF grants and QCDs are donor-initiated, with funds typically arriving by check or direct deposit, requiring little administrative work beyond acknowledgment. These gifts are often larger than typical cash donations, and can meet your current needs or grow your endowment for your future needs.

These are by far the highest impact and least effort gifts for both donors and nonprofits. If you prefer video training over reading an article you can access this information in a video format HERE.

Strategies to Educate Donors about DAF and IRA Gifts

When my dad, a lifelong farmer, was introduced to terms like IRAs and donor-advised funds, he understood them immediately. But for my mom, who didn’t have the same financial background, these terms felt foreign and overwhelming. It wasn’t until I sketched out a simple diagram—a visual with three buckets and three dollar amounts—that everything clicked for her.

That moment taught me an invaluable lesson: simplicity turns confusion into clarity. Donors don’t need technical jargon or complex explanations. They need giving options—like gifts of DAFs and IRAs—presented in ways that are familiar, accessible, and easy to understand.

Whether through compelling stories, clear instructions, or interactive seminars, nonprofits have powerful opportunities to help donors see how they can make a meaningful difference with these gifts.

Tell DAF & IRA Donor Stories Across Communication Channels

Stories are a powerful tool to connect people on a personal level and turn abstract or complicated concepts into relatable and easy-to-understand experiences.

There are two kinds of stories that are most effective in inviting DAF and IRA gifts:

- Show impact and inspire action with testimonials. Stories and quotes from beneficiaries and supporters are one of the best ways to illustrate the impact donors make with gifts from their DAFs and IRAs. These authentic accounts validate your impact, show potential donors how they can make a difference, and motivate them to invest in your mission.

- Share stories of donors who have made DAF or IRA gifts. Real-life examples help potential donors see themselves in previous donors’ stories and encourage them to explore similar giving opportunities. These stories also showcase the ease and impact of making DAF and IRA gifts, build confidence in the process, and inspire greater generosity.

For nonprofits, sharing compelling stories is more than about raising awareness—it’s a way to inspire action, foster trust, and deepen donor engagement.

Share "How to Make DAF & IRA Gifts" Information Broadly

Making the DAF and IRA gift process simple, familiar, and transparent increases the chance that you’ll receive these gifts.

There are two basic ways you can make the DAF and IRA gift process simple, familiar, and transparent:

- Explain how DAF and IRA giving works on your websites, newsletter, and print materials. The good news is, you don’t have to create brand new material. Remember the two kinds of stories we just talked about? Write each story in a way that includes how and why the DAF or IRA was used, and illustrate the impact they fuel. And just like that, you’ve killed two birds with one stone!

- Provide step-by-step instructions for DAF and IRA giving. Step-by-step instructions remove barriers and instill confidence in donors considering a DAF or IRA gift. Outline the process clearly, including who to contact, what information they’ll need, and how to complete their donation. A downloadable guide or checklist can make this information even more actionable.

If at any point you feel bogged down by all these steps, remember, a well-informed donor is more likely to take the next step toward making a gift.

Host a Legacy Giving Seminar

Educational events are a unique way to demystify planned giving options like DAFs and IRAs while fostering meaningful connections with donors. When you couple these events with thoughtful follow-up, these seminars can lead to long-term relationships and generosity for years to come.

Here’s how you can maximize these events in two steps:

- Host a well-planned seminar that not only educates but also inspires. Engage a trusted charitable advisor in the presentation. Leverage donor stories to introduce the powerful impact DAF and IRA gifts make. Limit the use of complex terms and illustrations. Walk donors through the simple steps of making these gifts.

- Follow up with your attendees. Ask them to complete a short survey at the end of the seminar. Reach out to personally thank them for attending. Ask if they have any questions. Better yet, ask if they’d welcome a followup visit. Begin the conversation about their goals and their charitable dreams.

With the right planning and intentional follow-up, educational events become a powerful tool to deepen relationships, inspire generosity, and help donors turn their charitable dreams into reality.

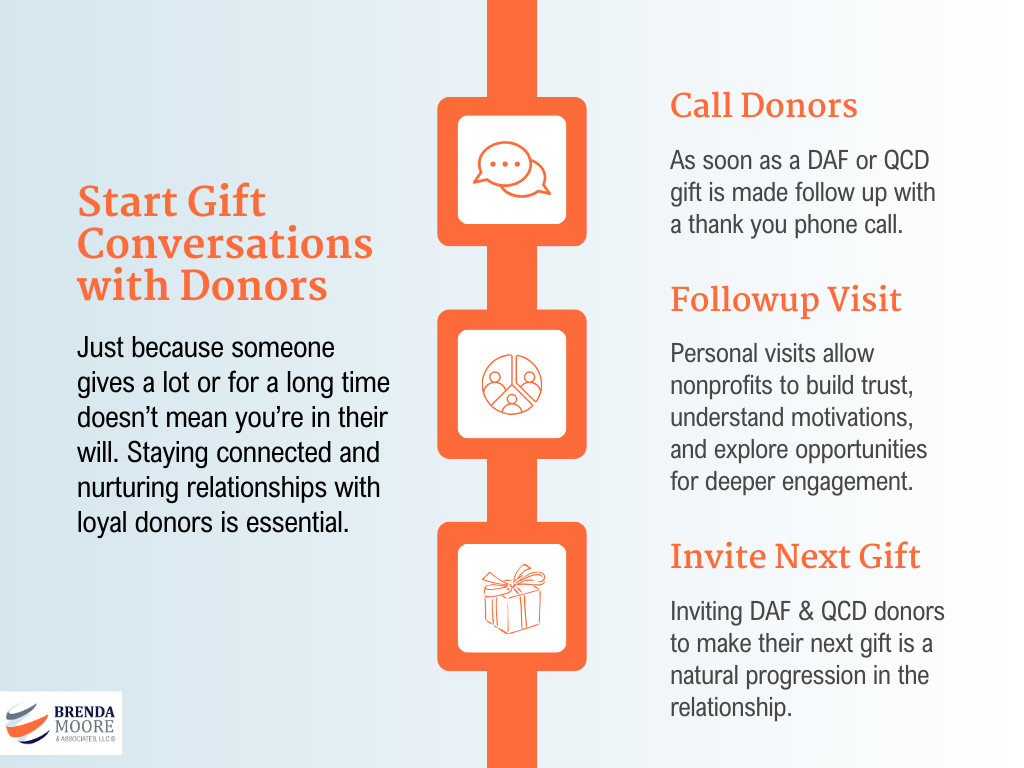

Starting Gift Conversations with Donors

I’ll never forget one occasion when I met with my parents to specifically discuss their legacy giving plans. It was a moment of both reflection and discovery…

As we zeroed in on the ministries they wanted to include their final plans, I noticed something surprising. A few organizations my parents had supported, either faithfully or significantly, weren’t being considered. Curious, I asked why. “We haven’t heard from them in years”, they said.

But others were included—like the seasonal church home that was then walking with them during Dad’s cancer treatments. These decisions weren’t just about financial support; they reflected relationships. The organizations that stayed present and engaged earned a place in my parents’ lasting legacy.

This experience opened my eyes to a reality many nonprofits overlook: just because someone gives a lot or for a long time doesn’t mean you'll be in their will. Staying connected and nurturing relationships with loyal donors isn’t just important—it’s essential.

Here’s a few steps to make sure you don’t overlook relationship with your most loyal donors:

Call Donors Immediately After Receiving a DAF or QCD Gift

Following up with donors after receiving a gift is more than a courtesy—it’s an opportunity to deepen relationships and show genuine appreciation.

Here are the three parts to a meaningful and effective follow up call:

- As soon as you receive a DAF grant or an IRA QCD make a personal thank-you phone call and tell your donors how much you value them.

- In the likely event your call goes to voicemail (because most of us don’t answer a phone number we don’t know), your phone call should be immediately followed up with an email or text, whichever is most appropriate for your donor.

- And, whether you speak to a person or voicemail, be sure to follow up your call with a handwritten note.

Thoughtful, timely follow-up creates a lasting impression, reinforcing the donor’s decision to support your mission and paving the way for future generosity.

Make a Followup Visit

Personal visits with donors allow nonprofits to build trust, understand motivations, and explore opportunities for deeper engagement. These conversations are essential for creating meaningful, long-term partnerships with supporters.

- Schedule a visit soon after receiving the gift. A thank you visit is an ideal time to express your personal appreciation and share more about the impact the gift will make. This timing ensures the donor feels valued—they’re still on your mind even though it’s been a few weeks—and creates space for genuine connection.

- Learn about donor motivations and future giving potential. During your visits, ask thoughtful questions to uncover what inspires the donor’s generosity (you can view a list of my go-to questions in the FREE GUIDE: Overcoming the Challenges of a Donor Visits). Understanding their motivations and interests provides valuable insights into their giving potential and helps tailor future engagement strategies.

If the thought of having face-to-face visits with your donors rattles your nerves, I want to encourage you! These visits with your wonderfully generous friends just might lead to the “holy moments” that make this the BEST part of your work!

Invite the Next Gift

Donors who have given through Donor-Advised Funds (DAFs) or Individual Retirement Accounts (IRAs) are already invested in your mission. Inviting them to make their next gift is a natural progression in the relationship.

You can tactfully invite both a current gift and a legacy gift in two steps:

- Share examples of how their current gift has made a specific impact. Illustrating the tangible outcomes their gift has made helps donors see the direct connection between their generosity and your mission. Invite them to use their DAF or IRA for their next gift…and their next!

- Invite Legacy Gifts from these sources. A simple way to transition might sound like this… “A growing number of our DAF/IRA donors have also named this organization as the final beneficiary of these funds. Could you see yourself making this type of legacy gift plan for this ministry?”

By sharing the impact of your donor’s support and presenting thoughtful opportunities for further investment, you invite them into next-level generosity and strengthen their commitment to your important work.

Your Next Steps for Nonprofits

Reading and learning about a new skill is great, but it won't change your organization until you put it into practice.

To give you a jumpstart here is a three step process to putting everything you just read into action:

Identify Donors Likely to Use DAFs or IRAs

You can maximize your time by focusing your energy connecting with supporters who are most likely to give through DAFs and IRAs. You should be looking for:

- Donors who have previously made DAF grants or IRA gifts.

- For IRA gifts, donors aged 70½ or older

- For DAF gifts, donors who have used their DAF to make gifts to other nonprofits

By targeting these key donor groups, you can build stronger relationships and increase the likelihood of securing impactful gifts through DAFs and IRAs. You can watch this video training to get a head start.

Develop a Plan to Educate and Invite

One of the best ways to consistently introduce your donors to DAF and IRA gifts is by developing a plan that includes:

- the use of your existing broad-based communications channels for telling donor stories and sharing “how to” instructions. Schedule the inclusion of these on at least a monthly basis, rotating different ways to give throughout the year.

- more personalized communication with targeted segments of donors. Develop and share episodic emails and letters with specific audiences on specific topics (e.g. early fall communication with your age 70+ donors introducing them to IRA QCDs)

- a legacy giving seminar to educate your friends on planned giving options. Include donor stories and illustrations that introduce IRAs and DAFs as opportunities for both current and future giving.

Remember, there’s no need to reinvent the wheel. Your plan should include the communication pieces covered in the education section of this article.

Schedule Time to Visit the People you’ve Identified

Jerry Panas said, “If you get the visit, you’re 85% toward securing the gift.” This means, if you’re not scheduling time to call donors and schedule visits, you’re not getting any closer to gifts.

When I was a Director of Development I scheduled the first twenty minutes of my work day to call or email donors and ask to set appointments. This ensured that I was working toward new gifts every day. You can find a customizable phone script for scheduling donors visits in the Free Guide: Overcoming The Challenges of a Donor Visit.

Moving Forward

My parents’ charitable gifts weren’t just financial transactions—they were reflections of their priorities and the relationships they cherished most. When nonprofits walk alongside loyal donors to create a plan that aligns their resources with what they value, it can lead to extraordinary transformation—not just for the donors but for your mission as well.

Navigating the process of inviting and managing DAF and IRA gifts doesn’t have to feel overwhelming. With the right strategy and support, you can simplify the steps, focus on what matters most, and confidently inspire donors to deepen their generosity and impact.

If you still have questions about your next steps for inviting gifts from DAFs and IRAs, schedule a no-cost consultation call and let us remove the guesswork. Together we can discern how you can move forward and make these transformative gifts a regular part of your fundraising!